How to Source Injection Molding Services from China

The important meeting has recently finished, your new project has the green light, the schedule is tight, and funding is, to put it mildly, limited. Then someone—maybe your boss, maybe the finance director—utters the phrase that sends a little jolt down every project manager’s spine: “We should look at sourcing this from China.”

Naturally, you agree. It seems sensible at first glance. The potential savings can be massive. However, your brain is racing with concerns. You’ve heard all the horror stories, right? Quality failures, endless communication gaps, shipments arriving months late and nothing like the prototype. It’s like balancing on a tightrope between a massive cost advantage and project disaster.

However, here’s the reality. Procuring plastic mold needn’t be a roll of the dice. It’s a project, just like any other. And its outcome hinges on the approach you take. It isn’t about the cheapest offer but about choosing the right supplier and running the process transparently. Ignore the nightmare anecdotes. Here’s a practical playbook to nail it.

First Things First: Your Homework

Before you mention “supplier” or browse Alibaba, organize your internal data. Honestly, more than half of all overseas manufacturing problems start right here, with a weak or incomplete information package. Don’t assume a remote factory can guess your needs. A vague RFQ is like telling a contractor to bid on “a house.” The responses you get will be all over the map, and none of them will be useful.

Your goal is to create a Request for Quotation, or RFQ, package that is so clear, so detailed, that it’s nearly impossible to misinterpret. It’s the cornerstone of your entire effort.

What should you include?

Begin with 3D CAD models. These are non-negotiable. Use standard formats such as STEP or IGS to ensure compatibility. This is the authoritative CAD geometry.

Yet 3D models don’t cover everything. You also need detailed 2D drawings. This details critical info missing from the 3D file. Think tolerances, material grades, finish specs, and any feature-critical notes. Any seal surfaces or critical hole sizes must be clearly labeled.

After that, material choice. Don’t label it simply “Plastic.” Nor just “ABS.” Be explicit. If you need SABIC Cycolac MG38 in black, say exactly that. Why be exact? Because there are thousands of plastic variations. Specifying the exact resin grade ensures you get the strength, flexibility, UV resistance, and color consistency you planned for with what is plastic mold.

Your supplier might propose substitutes, but you must set the baseline.

Finally, include the business details. State your EAU. They need clarity: is it 1,000 total shots or a million units per annum? Tool style, cavity count, and unit cost are volume-driven.

The Great Supplier Hunt

With your RFQ perfected, now, who do you send it to? The internet has made the world smaller, but it’s also made it a lot noisier. Finding suppliers is simple; finding quality ones is tough.

You’ll probably kick off on Alibaba or Made-in-China. These are great for casting a wide net and getting a feel for the landscape. Treat them as initial research tools, not final solutions. You’ll want to quickly build a list of maybe 10 to 15 companies that look promising.

But don’t stop there. Think about engaging a sourcing agent. Yes, they take a cut. But a good one has a vetted network of factories they trust. They bridge language and cultural gaps. On your first run, this is like insurance. Think of it as insurance for your project timeline.

Another classic method? Trade shows. If you can attend, shows such as Chinaplas transform sourcing. In-person meetings trump emails. Inspect prototypes, interview engineers, and sense their capabilities. Plus, ask peers for referrals. Ask other project managers in your network. Peer endorsements carry huge weight.

Separating Real Suppliers from Pretenders

With your RFQ dispatched to dozens of firms, the quotes will start trickling in. Some prices will undercut logic, others will shock you. Your task is to filter them down to 2–3 credible finalists.

What’s the method? It involves both metrics and gut feel.

First, look at their communication. Are their replies prompt and clear? Do they communicate effectively in English? But the key: do they probe your RFQ? Top vendors will critique and inquire. For instance: “Draft angle here could improve mold release. Tolerance check via CMM adds cost—proceed?” This is a massive green flag. It shows they’re engaged and experienced. Anyone who simply agrees to all specs is a red flag.

Next, dig into their technical capabilities. Ask for a list of their equipment. Review examples of parts akin to your design. A small-gear shop won’t cut it for a big housing.

Next up: the factory audit. You can’t skip this. You would never hire a critical employee without an interview, so why would you send tens of thousands of dollars for a tool to a company you’ve never truly vetted? You can either go yourself or, more practically, hire a third-party auditing firm in China to do it for you. They perform a one-day factory inspection. They authenticate the firm, review ISO credentials, evaluate machines, and survey operations. It’s a tiny cost for huge peace of mind.

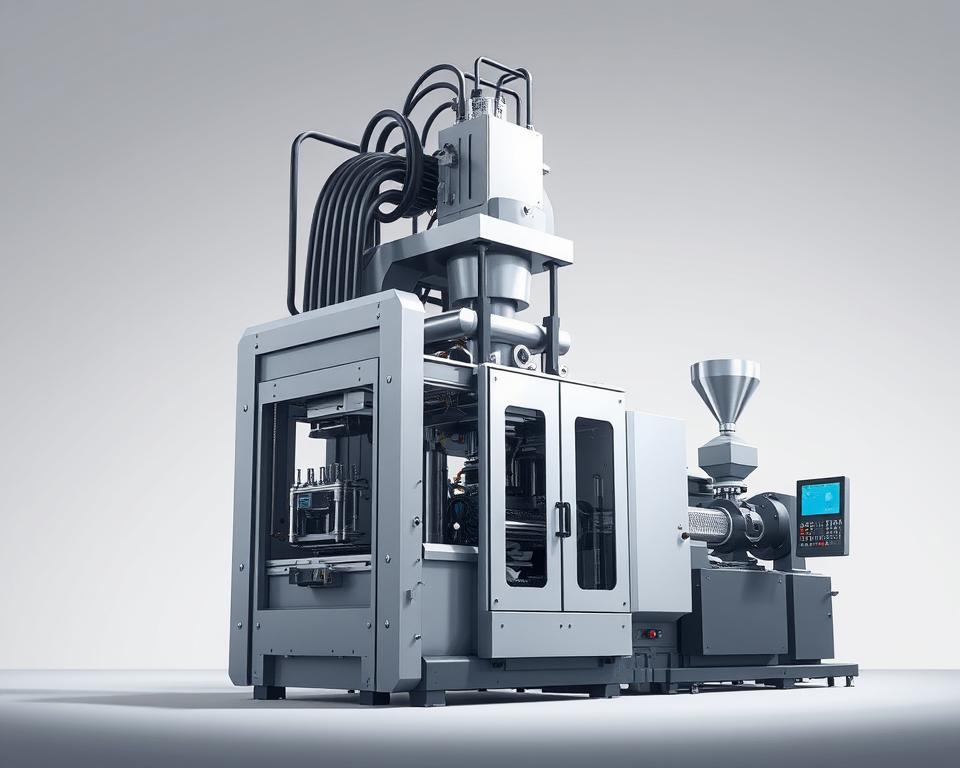

Transforming CAD into Real Parts

You’ve selected your partner. you’ll agree on terms, typically 50% upfront for tooling and 50% upon first-sample approval. Then comes the real action.

Initially, expect a DFM report. Design for Manufacturability (DFM) is essential. It’s their professional review of your CAD. They’ll flag thick sections prone to sink, sharp edges that stress, or insufficient draft. A thorough DFM is a sign of a professional operation. It’s a collaboration. Together, you tweak the design for best manufacturability.

With DFM sign-off, toolmaking begins. In a few weeks, you’ll see “T1 samples are on the way.” These are your initial mold shots. It’s your first real test.

Be prepared: T1 samples are almost never perfect. That’s standard process. Look for small flaws, slight size errors, or surface marks. You supply feedback, they tweak the tool, and T2 plastic mold in China samples follow. This process might take a couple of rounds. The key for you, as the project manager, is to have this iteration loop built into your timeline from the start.

Eventually, you will receive a part that is perfect. It matches all specs, has a pristine finish, and works as required. This is now the benchmark sample. You sign off, and it serves as the master quality reference.

Final Steps to Mass Production

Receiving the golden sample seems like victory, but you’re not done. Now comes full-scale production. How can you keep part #10,000 matching your golden sample?

Put a strong QC process in place. Typically, this means a pre-shipment audit. Again, you can hire a third-party service. For a few hundred dollars, they will go to the factory, randomly pull a statistically significant number of parts from your finished production run, and inspect them against your 2D drawing and the golden sample. You receive a full report with images and measurements. After your approval, you release the shipment and final funds. This audit shields you from mass defects.

Finally, think about logistics. Know your shipping terms. Is your price FOB (Free On Board), meaning the supplier’s responsibility ends when the goods are loaded onto the ship in China? Or EXW, where you handle everything from their gate? Your Incoterm selection drives landed expenses.

China sourcing is a long-haul effort. It hinges on strong supplier relations. Treat them like a partner, not just a line item on a spreadsheet. Clear communication, mutual respect, and a solid process are your keys to success. It’s a challenging project, no doubt. But with this roadmap, you can succeed, achieve savings, and maintain quality. You’re set to succeed.